Painless Tax Filing for Singapore's SMEs

Easy, hassle-free and fast. Convert your accounting profit to taxable profit in 3 simple steps within 10 minutes.

How It Works?

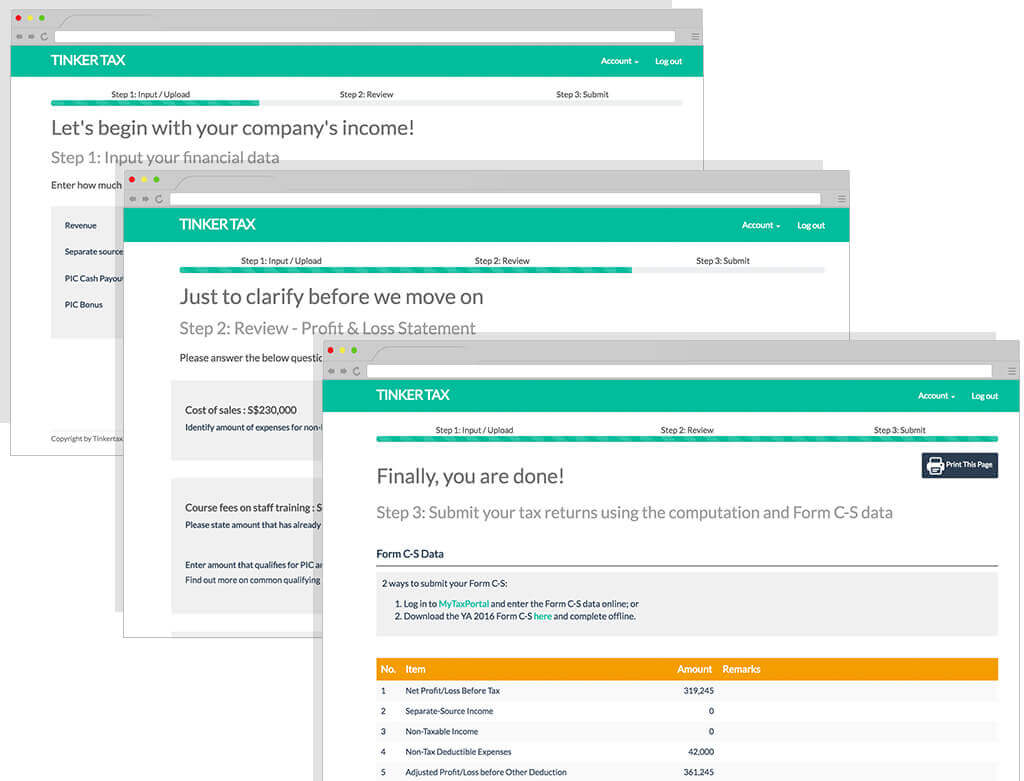

Convert your accounting data to tax in 3 steps

Step 1: Upload or Enter your Accounting Data

Upload your trial balance using Microsoft Excel, or key in your accounting data into our system.

Step 2: Help Us Understand Your Data

We will ask you a few questions based on your accounting data to help us understand the nature of your transactions. We also provide customised links to IRAS resources in case you need clarification.

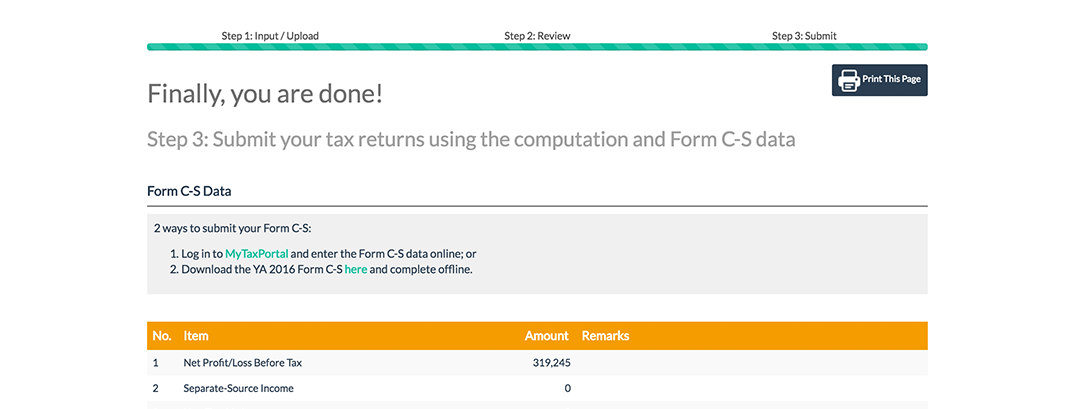

Step 3: Review your Tax Computation and Form C-S Data

We will list our tax treatment and assumptions all in one place and generate your tax computation for you. Review them and make changes if necessary with just one click.

In 3 simple steps, you will have your full tax computation and tax form data ready for submission to IRAS!

You Don’t Need to Know Tax

Not familiar with Singapore corporate tax regulations? No worries, leave this bit to us. Let us deal with the ever-changing rules while you focus on growing your business.

- Answer easy questions about your business in plain language

- Get help via links to IRAS resources in relation to your query

- Identify deductions and tax incentives that you qualify for

- Updated every year with the latest tax policies and incentives

Let us help you step by step

- Import your accounting records

- Walk you through the relevant accounting entries

- Help you accurately report and maximize your deductions

- Complete within 10 minutes

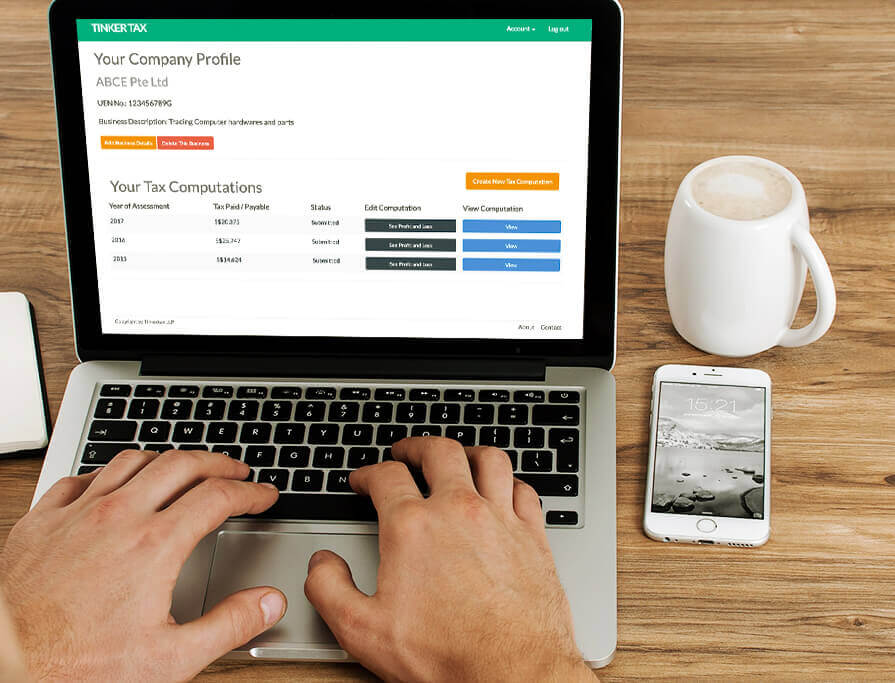

Keep and retrieve your records anytime

- Keep track of your tax and accounting records all in one place

- Retrieve these information any time

- Download your tax computation and tax form data for safekeeping

- Great if you want to review your tax position

Our Promises

No Hidden Costs

For the price you pay, you will be able to access all features that are available to our users for each year of assessment. There are no additional costs.

Data Security

We will protect your data from unauthorised access. Even we cannot access your data without your permission.

Unlimited Free Support

Do not worry if there is a problem. We will always assist you via email and phone call if there is a need.

Satisfaction Guarantee

Try out our software. You do not have to pay if you are not satisfied.

Accuracy Guarantee

If you have to pay IRAS penalty due to Tinkertax’s software error, we will refund you the penalty and interest.

Pricing

If you are not satisfied, contact us within the first 14 days and we'll send you a full refund.

S$79 / Year of Assessment

When you click on “Try Now”, you will have access to all our features in our Basic plan. You will only pay when you want to see your tax returns (Form C-S) and tax computation.

Contact Us

Want to work with us? Leave your contact here and we will get back to you.