7 Steps to Calculating Estimated Chargeable Income (ECI)

Thiam Hock

Your financial year has ended.

Your first tax obligation is to file your Estimated Chargeable Income (ECI).

But what is ECI? How do you calculate it?

In this article, we will share why it is important to file the correct ECI, and how to calculate it.

What is Estimated Chargeable Income (ECI)?

ECI, as the name suggests, is the estimated income for the financial year ended. As a business owner, you need to file ECI with IRAS because they want to raise an early assessment.

Since it is only estimated, you do not need to be 100% accurate. If your actual chargeable income is different, IRAS will raise an amended assessment.

The Importance of Filing ECI

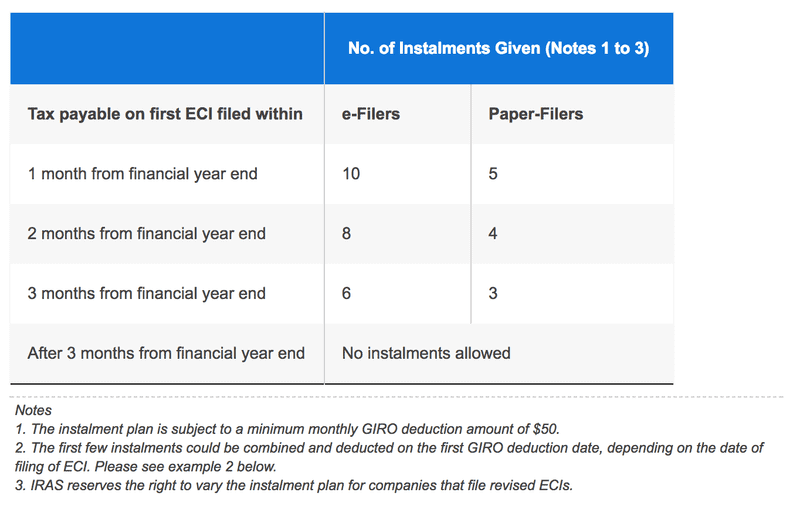

Filing ECI is important if you are in a tax payable position. IRAS granted businesses which file ECI early instalments in their tax payments.

Instead of paying a lump sum of taxes, you will be paying your taxes over a few months. This will help in your business cash flows.

Source: Inland Revenue Authority of Singapore

Source: Inland Revenue Authority of Singapore

But do note that if you meet the following conditions, you do not have to file ECI:

Your ECI is nil. Your revenue is less than $5 million. Unless you are very sure, it is better for you to go through the below process to calculate your ECI.

Steps in Calculating ECI

To calculate your ECI, you need to have your year end accounts in place. In particular, you should have the following documents:

Statement of Profit and Loss; Fixed Assets Addition and Disposal; and Previous Year Tax Computation and Notice of Assessment These items need not be final. If you need help in getting the first 2 items, do visit our guide on bookkeeping tips.

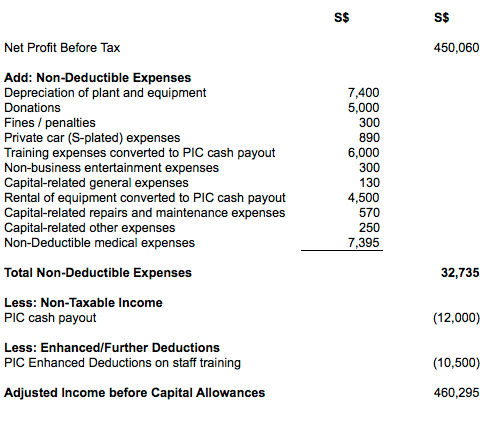

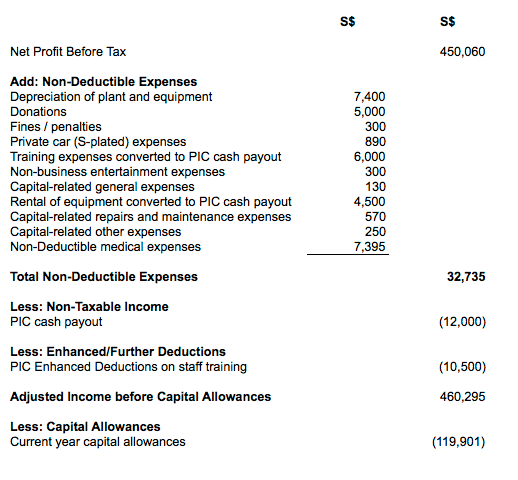

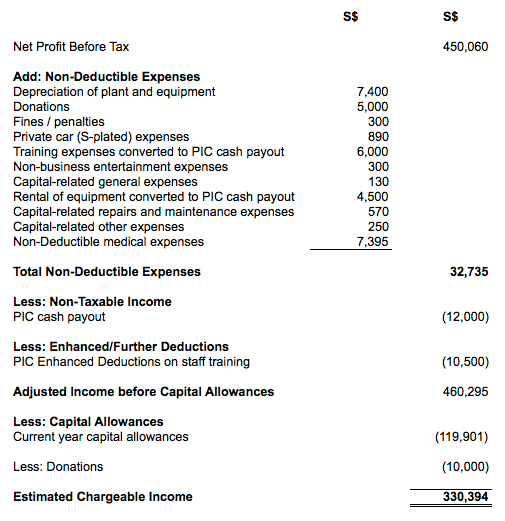

The starting point in calculating your ECI is your net profit before tax.

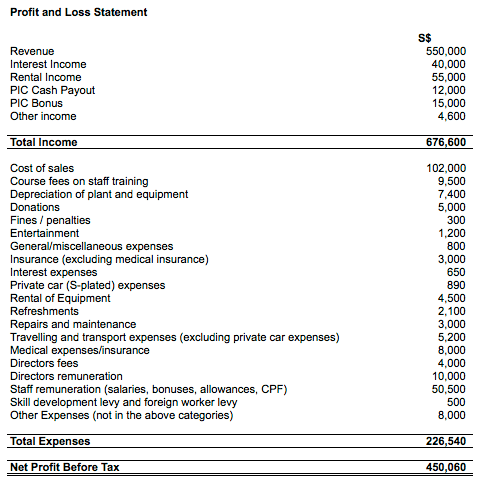

We will use the below simple profit and loss statement as an example.

Step 1: Adding Back Non-Tax Deductible Items

The first step is to add back non-tax deductible items. Not all items that you incurred are deductible in tax. Some common examples are:

Depreciation / Amortisation Private expenses not relating to generating income Fines and penalties due to non-compliance Expenses relating to S-plate private motor vehicles (Petrol, parking, maintenance) Capital expenses or losses (e.g. loss on disposal of assets) Expenses that are capital in nature (e.g. professional fees relating to capital transactions) Donations Productivity and Innovation Credit (PIC) items which you have claimed cash payout The above list is not exhaustive. You can find out more about more about expenses deductibility from IRAS website. Otherwise, comment below, and we will assist you.

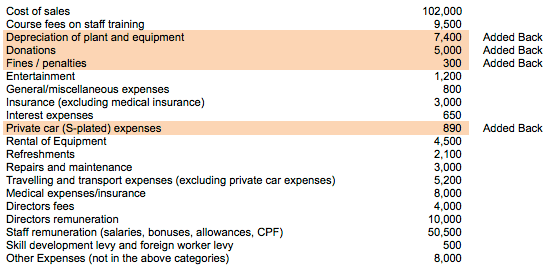

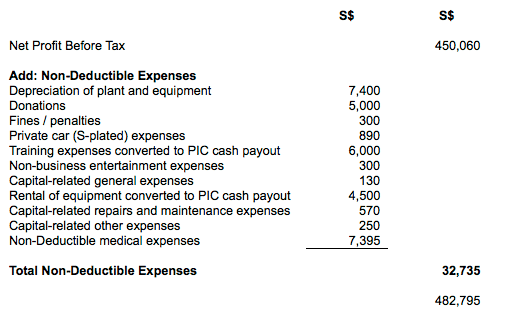

Based on the Profit and Loss Statement, I have identified the following non-deductible expenses:

I marked these expenses as “Added Back”.

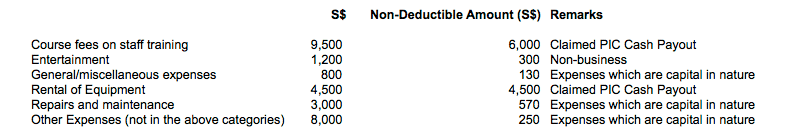

Next, there might be specific expenses within other categories that are non-deductible as well. For example, I might have non-business expenses under entertainment, or capital expenses under repairs and maintenance.

For this article, let say I have identified the following additional non-deductible expenses:

A Note About Medical Expenses

Medical expenses are tax-deductible expenses as long as they are capped at 1% of total remuneration.

Total employee remuneration includes:

- Employees’ salaries, allowances and bonuses;

- Directors’ remuneration;

- CPF contributions

But exclude the following:

- Directors’ fees;

- Medical expenses;

- Cash allowances in lieu of medical expenses

- Benefits-in-kind;

- Skills Development Levy (SDL)

- Foreign Worker Levy (FWL)

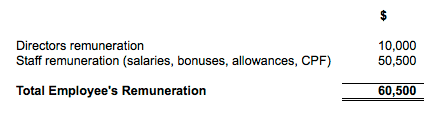

In this example, our total employee remuneration is:

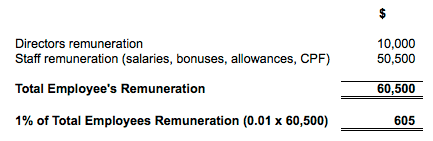

The tax deductible medical expenses are:

Given that the medical expenses amount to S$8,000, this means that $7,395 amount ($8,000 – $605) is not deductible.

Note: Under some circumstances, the cap can increase to 2%.

Add your non-deductible expenses to net profit before tax.

Step 2: Deduct Non-Taxable Income

Like expenses, there are also non-taxable income. Some common non-taxable incomes include:

- PIC cash payout

- Income of capital nature (e.g. gain on disposal of assets)

- Income earned in foreign jurisdiction not remitted into Singapore

Again, the above list is not exhaustive. Visit IRAS website on Taxable and Non-taxable income for more information.

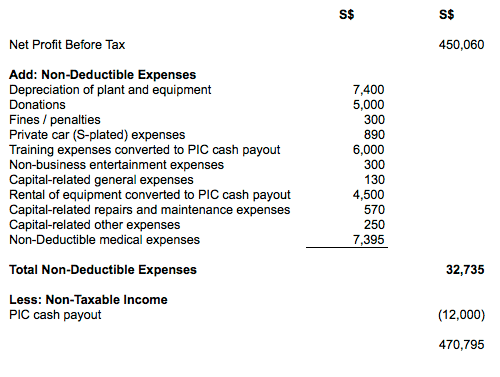

Based on the example, we have identified that PIC cash payout is a non-taxable income.

Deduct the non-taxable income from the number you get in Step 1.

Step 3: Deduct Further and Enhanced Deductions

You might be eligible for further or enhanced deductions. Common examples of further / enhanced deductions include:

- PIC items where you did not claim cash payout;

- Renovation and refurbishment expenses under Section 14Q of the Income Tax Act; and

- Double tax deduction for internationalisation scheme.

If you have any of the above items, deduct the amount from the number you get in Step 2. You can click on the above links to find out more about these expenses and how to calculate it.

For this example, we have $3,500 worth of PIC-qualifying expenses where we did not claim cash payout. Such expenses qualify for 300% enhanced deductions under the PIC scheme.

We will deduct such amount in our tax computation:

At this step, we have calculated the adjusted income before capital allowances. If you do not have the following:

- Approved donations made to IPC

- Purchase or dispose fixed assets during the financial year

- Unclaimed capital allowances from previous years of assessment

- Unutilised capital allowances, losses, and donations The adjusted income before capital allowances will be your estimated chargeable income. If not, read further on how can you reduce your chargeable income further.

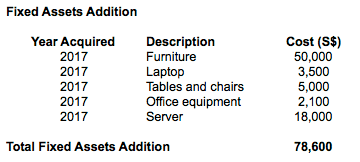

Step 4: Calculate and Deduct Your Capital Allowances

While you are not able to claim deductions on capital items, you may do so with capital allowances. The calculations for capital allowances are different.

To begin, list down all your fixed assets acquisitions. Exclude assets that you cannot claim capital allowances such as:

- Private motor vehicles

- Lightings and fittings

- Doors, roller shutters, and gates

- Fixed partitions, walls, walls tiles and other finishes

- Water and gas pipings

- Container office

- PIC-qualifying assets where you have claimed cash payout You can read more about capital allowances over at IRAS website.

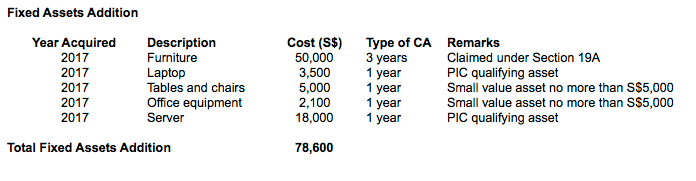

There are three types of capital allowances for most businesses:

- Section 19A: Where you claim capital allowances over 3 years

- Automation Equipment / PIC: Where you claim capital allowances over 1 year

- Small value asset: Where you claim capital allowances over 1 year for assets no more than $5,000 (less than $30,000 in total) Note: There is also Section 19 capital allowances. But you can ignore that as most businesses do not use Section 19 capital allowances.

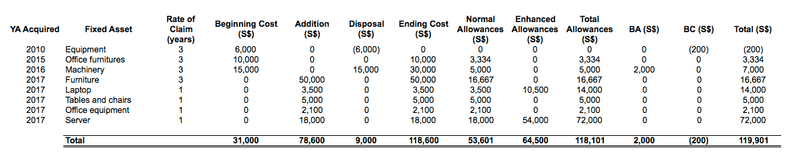

Let’s assume that you acquire the following assets:

First, determine what type of capital allowances (ca) should you apply to these assets.

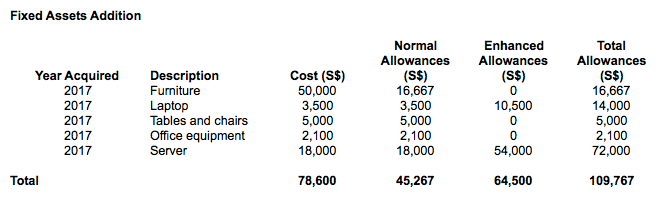

Then, calculate the capital allowances which you may claim. Also, factor in the PIC enhanced allowances (if you did not claim cash payout for such asset).

Finally, add these amount together, and you will get your capital allowances.

For the fixed assets addition in YA 2017, we can claim a total of $109,767 allowances.

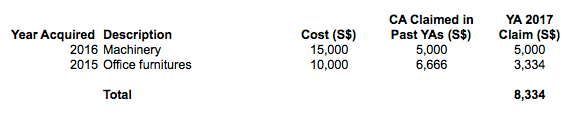

Step 5: Add Past Year Capital Allowances (Optional)

Look at your tax computation for the previous year.

Check if there is any:

- Assets where you claimed capital allowances over 3 years and still have positive tax written down value?

- Assets where you defer claiming of its capital allowances? If your answer to the above is yes, then you can further reduce your tax payable.

To calculate the past year capital allowances, divide the cost of these assets by 3. Make sure you check that the total capital allowances claimed is no more than the cost of the asset.

In this example, I have 2 assets acquired in the past:

Do note the difference in calculations for “Office furniture” to take account into rounding differences.

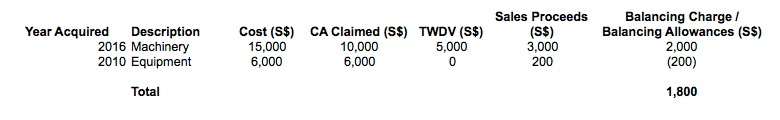

Step 6: Add Back or Deduct Balancing Allowances and Balancing Charges (Optional)

Note: You can skip this step if you did not dispose any fixed assets.

When you dispose fixed assets, there are additional adjustments to be made.

Balancing allowance and charge is the difference between sales proceeds and the tax written down value of the asset.

Tax written down value (TWDV) is the difference between the cost of fixed asset and capital allowances claimed. You can think of TWDV as the net book value in tax.

When your sales proceeds is more than your TWDV, you will have a balancing charge. Balancing charge is like a “negative” capital allowances. It will increase your chargeable income.

When your sales proceeds is lower than your TWDV, you will have a balancing allowance. Balancing allowance is like capital allowance. It will reduce your chargeable income.

Note that the $200 over here is negative as it is a balancing charge.

Combining Step 4 to 6, this is our capital allowances schedule:

We can claim a total of S$119,901 worth of capital allowances:

Step 7: Deduct any unutilised capital allowances, unutilised losses, unutilised donations and donations

Check your last year tax computation and NOA. Do you have any unutilised capital allowances, losses and donations? If yes, deduct them from the amount you get in Step 6.

In this example, I am going to assume that there is no unutilised capital allowances, losses, or donations.

Finally, if you have made a donation this year, you can deduct 2.5 times of the amount as well. The donation must be made to approved IPC. You can check that amount in your tax portal.

We assume that we have S$10,000 worth of deductible donations.

With this, you have calculated your estimated chargeable income of S$330,394.

To file it, you can go to your tax portal. You also need to fill in your revenue.

Conclusion

Estimated Chargeable Income is an estimation. You do not have to be exact.

But you should try to make it as accurate as possible. Afterall, you wouldn’t want to pay higher taxes only to recover it from IRAS later.

If you find the above steps too difficult, I would like to invite you to try out our software – TinkerTax. TinkerTax automates the following for you:

- Determine the deductibility of your expenses and taxability of your income;

- Calculate your non-deductible medical expenses;

- Raise relevant questions to clarify the nature of your profit and loss item and adjust them in your tax computation;

- Calculate your capital allowances;

- Calculate your balancing allowances and balancing charges;

Using TinkerTax, you should need no more than 15 minutes to get your ECI. Moreover, it is free.